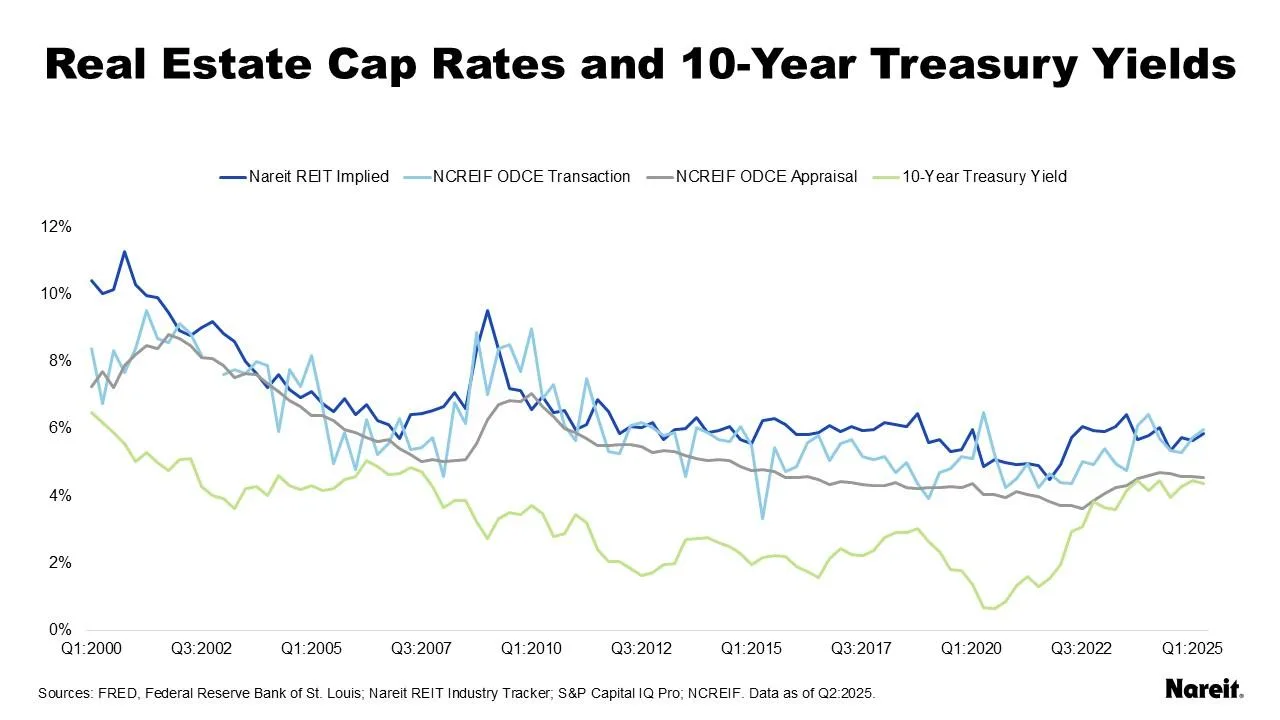

- Private real estate appraisals remain out of step with current market conditions, keeping cap rates artificially low and valuations elevated.

- REIT implied and private transaction cap rates have historically aligned, underscoring the market-driven accuracy of these measures.

- The failure to adjust private asset valuations hampers transaction activity and boosts investor interest in REITs offering real-time price discovery.

A Growing Valuation Disconnect

According to Nareit, there’s a sustained divergence in commercial real estate cap rates, with private real estate appraisals trailing significantly behind market-based indicators.

While REIT implied and private transaction cap rates remain closely aligned, appraised values have resisted adjusting to higher interest rates and evolving market conditions.

The misalignment is especially visible in the spread between private appraisal cap rates and the 10-year Treasury yield. From Q2 2024 through Q2 2025, this spread averaged just 32 basis points—an unusually tight margin that doesn’t reflect broader market realities.

What the Data Shows

Historical data since 2000 paints a clear picture:

- REIT implied and NCREIF transaction cap rates have averaged a 55-basis-point spread, reflecting their market responsiveness.

- Over the past five quarters, that spread narrowed to just 11 basis points—further highlighting the tight linkage between these two market-driven indicators.

- By contrast, private appraisal cap rates have only maintained a spread below 50 basis points over Treasuries in two prior instances, making today’s tight spread highly atypical.

Why It Matters

The lag in private appraisals isn’t just academic—it directly affects transaction volume and investor outcomes. Overvalued private portfolios discourage buying and selling, hindering liquidity and delaying price discovery. Investors in private funds may also end up paying inflated management fees based on outdated NAVs.

By contrast, REITs offer investors transparency and real-time pricing aligned with market movements. This efficiency has made REITs more attractive amid valuation uncertainties in the private space.

Looking Ahead

Until private valuations reflect current market dynamics, the disconnect will likely continue to impede transaction activity. In the meantime, REITs stand to benefit from their ability to offer market-aligned exposure to high-quality real estate assets.

As interest in liquidity and valuation clarity grows, the REIT sector may continue to attract capital seeking timely and accurate reflections of market value.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes