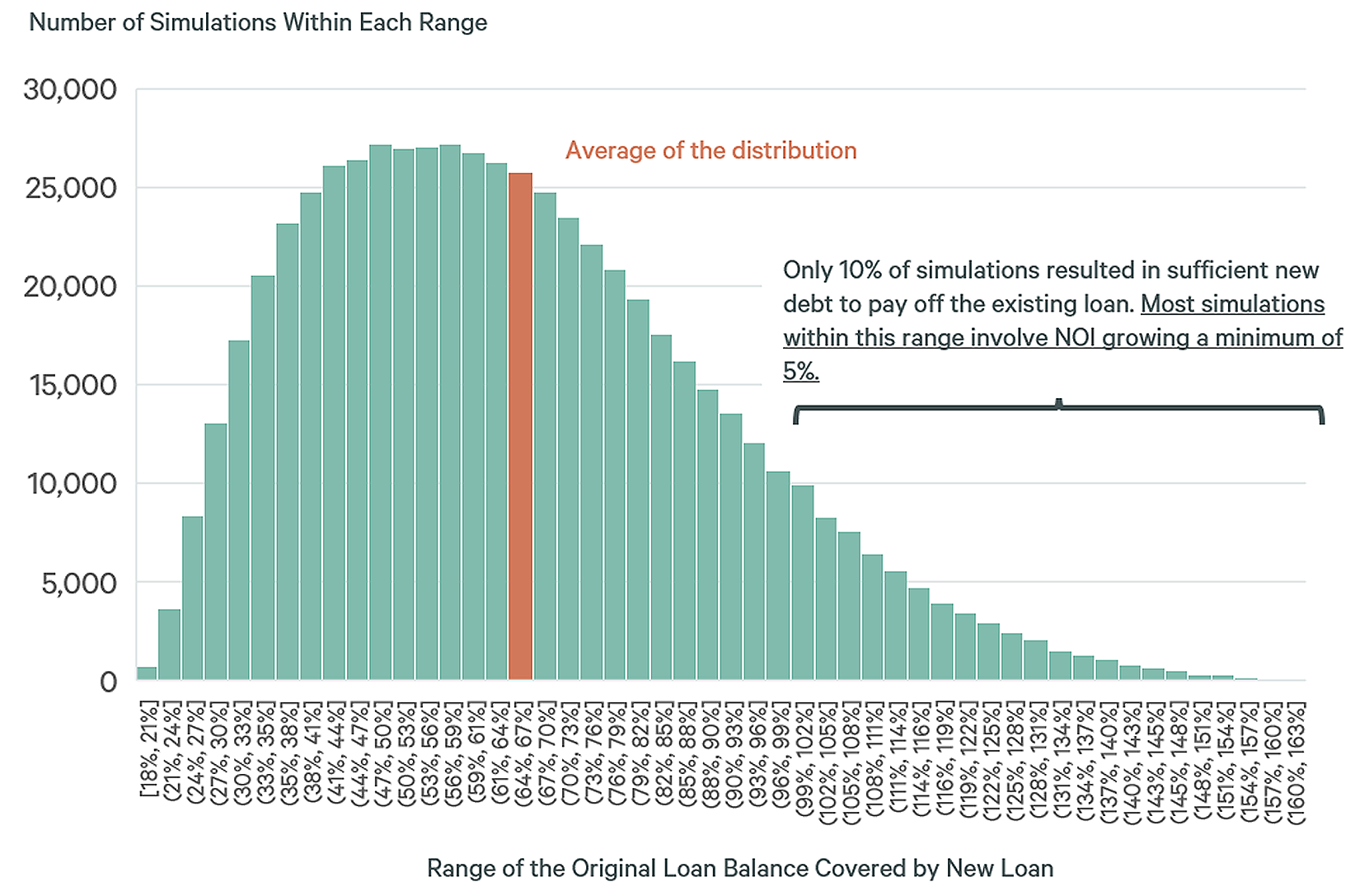

- CBRE’s simulation found that a typical 2019 office loan would face a 35% funding gap if refinanced today, with new loans only covering 65% of the outstanding balance.

- Of over 611K modeled scenarios, just 10% resulted in a new loan fully covering the old balance—typically requiring an unrealistic 5%+ growth in NOI.

- The findings underscore how deteriorating fundamentals and tighter lending standards are creating serious capital structure challenges for office owners.

Office Financing Hits A Wall

A CBRE simulation has confirmed what many in commercial real estate already suspected, reports GlobeSt. Refinancing office properties in today’s market is exceptionally difficult, especially for assets financed during the pre-pandemic peak in 2019.

What CBRE Modeled

The analysis looked at a hypothetical loan originated in 2019 with favorable terms: a 4% interest rate, $10M in net operating income, 5% cap rate, 72% LTV, and a $144M loan. The debt service coverage ratio was 1.74, and the debt yield was 6.94%. The simulation then applied a wide range of refinancing variables, such as rising interest rates, stricter underwriting standards, and changes in NOI or amortization.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Debt Gap Dynamics

The simulation concluded that a new loan today would only fully refinance the existing loan in 10% of cases—and only if NOI had grown by at least 5%, a rate CBRE described as unrealistic for most office properties. Without NOI growth, avoiding a debt gap required an 18% amortization minimum. In most modeled outcomes, borrowers would need to inject new equity or restructure original loans to cover a 35% shortfall.

A Deeper Crisis

CBRE said the findings emphasize the fragile state of capital structures for office properties, especially those financed in 2019—a year now considered one of the worst times to buy into the office sector.

Why It Matters

These funding gaps represent more than just a short-term refinancing issue. They expose systemic weaknesses that could fuel distress sales, lender losses, or debt restructurings in a sector still struggling with occupancy, valuation, and demand uncertainty.

What’s Next

With interest rates elevated and underwriting tight, the office market could see more forced sales and capital calls. Lenders and owners will likely need to get creative to bridge the gap and avoid defaults. Strategies may include loan modifications, preferred equity infusions, or discounted payoffs.