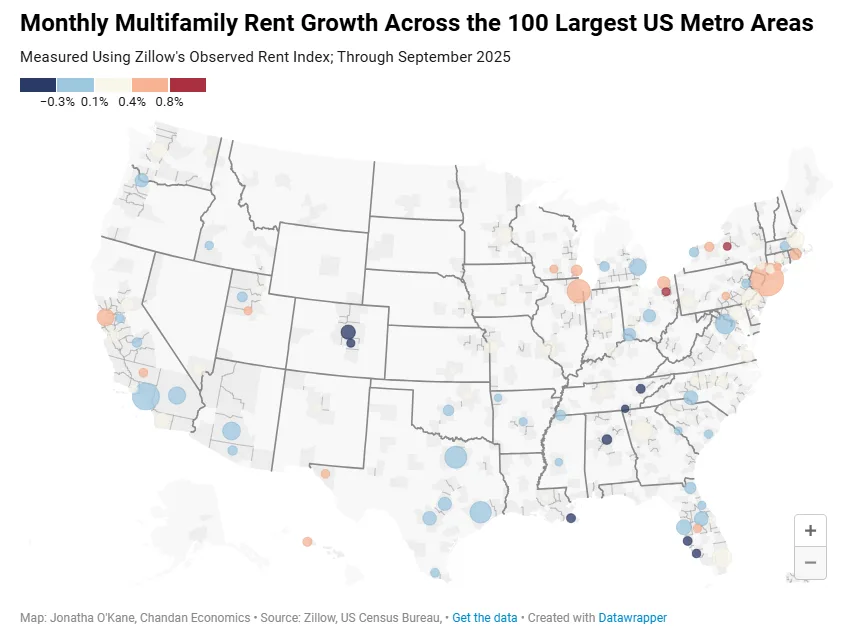

- Rents rose in 69.4% of US multifamily markets in September, holding relatively steady from the prior month and continuing a recent rebound from early-year lows.

- National rent growth came in at 0.14% month-over-month, equivalent to 1.7% annualized, but still trails CPI inflation near 3%.

- Syracuse, NY, and Akron, OH, led the country in both monthly and annual rent gains, while several Sun Belt markets, including Cape Coral and North Port, FL, saw notable declines.

- Annual rent growth held at 2.0% for the third straight month, continuing a two-year trend of stable, low-single-digit increases.

Rental Market Rebounds Slightly in September

New data from Zillow’s Observed Rent Index (ZORI) shows multifamily rent growth ticked up again in September, with 69.4% of tracked markets posting positive rent gains, a slight dip from August’s 69.8%, but still well above the March 2025 low of 61.4%.

The current trend suggests renewed market momentum after a slower start to the year, per Chandan Economics.

Modest Monthly Gains — But Below Inflation

Nationally, multifamily rents rose by 0.14% month-over-month, which annualizes to about 1.7%. While this is a positive sign for landlords, it remains below the 3% pace of consumer price inflation, meaning real (inflation-adjusted) rents are slightly declining.

At the metro level, Akron, OH (+1.13%) and Syracuse, NY (+1.09%) led monthly rent growth, followed by Lakeland, FL (+0.75%), Madison, WI (+0.67%), and San Francisco, CA (+0.64%).

Meanwhile, the steepest monthly declines came from Knoxville, TN (-0.60%), Cape Coral, FL (-0.58%), and North Port, FL (-0.58%), continuing a cooling trend in parts of the Sun Belt that had previously seen rapid rent escalation.

A Stable, Low-Growth Environment

On an annual basis, national rent growth held steady at 2.0% in September — the third month in a row at that level. Despite market fluctuations, rent growth has stayed between 1.8% and 2.5% for the past two years, offering unusual stability for multifamily operators.

Top year-over-year gainers include:

- Syracuse, NY: +6.9%

- Chicago, IL & Akron, OH: +6.2%

- Rochester, NY: +6.1%

- San Francisco, CA: +6.0%

In contrast, Cape Coral, FL (-4.8%) posted the sharpest annual decline, followed by Austin, TX (-4.0%) and North Port, FL (-3.5%). These results reflect ongoing normalization in overbuilt or overheated Sun Belt markets.

Why It Matters

Multifamily rent growth remains in positive territory but has cooled meaningfully from the double-digit spikes of recent years. For developers, operators, and investors, the data points to a maturing rental market with regional divergence — where some Midwest and Rust Belt cities show strong growth, while some southern metros are undergoing corrections.

While rent increases are still occurring in most markets, real rents are eroding slightly in inflation-adjusted terms, suggesting limited pricing power for landlords in the current economic environment.

What’s Next

As demand stabilizes and new supply continues to hit the market, particularly in high-growth metros, expect regional performance gaps to persist. The steady 2% national growth rate signals a return to pre-pandemic norms, but local factors — including job growth, affordability, and construction pipelines — will remain key in shaping outcomes market-by-market.

With inflation still elevated and interest rates likely to stay high through early 2026, rent growth may remain modest, reinforcing the importance of operational efficiency and localized strategy for multifamily stakeholders.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes