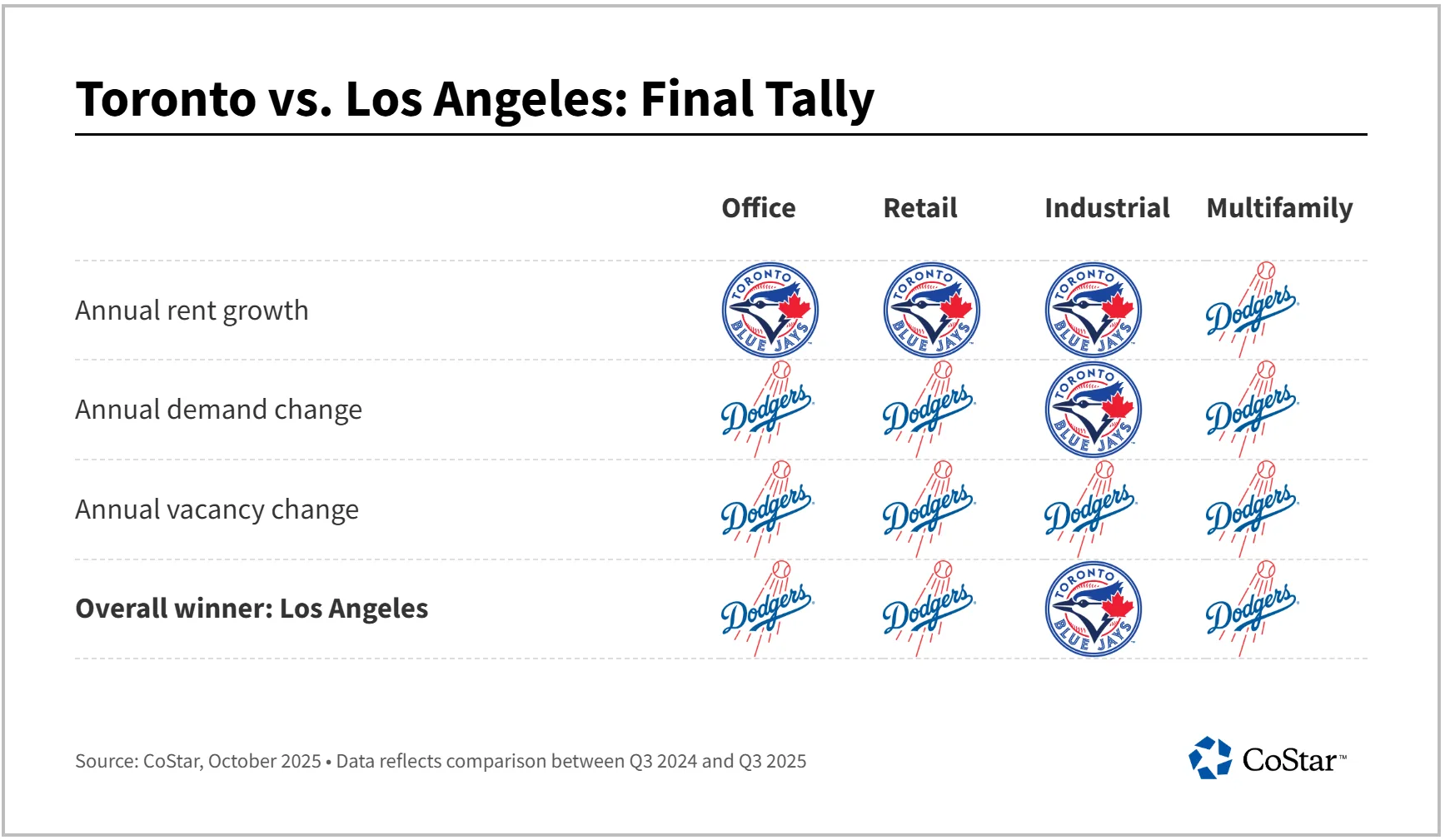

- Los Angeles takes the edge in three out of four key commercial real estate sectors—multifamily, office, and retail—outperforming Toronto despite structural headwinds.

- Toronto’s industrial market shines, buoyed by constrained supply and future recovery potential, while LA’s sector struggles under record availability and declining rents.

- High vacancies and affordability challenges weigh on both cities, but LA’s earlier market corrections and more balanced pipelines give it a slight advantage overall.

A Tale of Two Cities

As the Dodgers and Blue Jays compete for baseball glory, Los Angeles and Toronto are also squaring off in a less visible but equally competitive arena—commercial real estate. According to CoStar Analytics, both cities have weathered high vacancies and economic uncertainty in recent years, but each has taken a different path through shifting market dynamics.

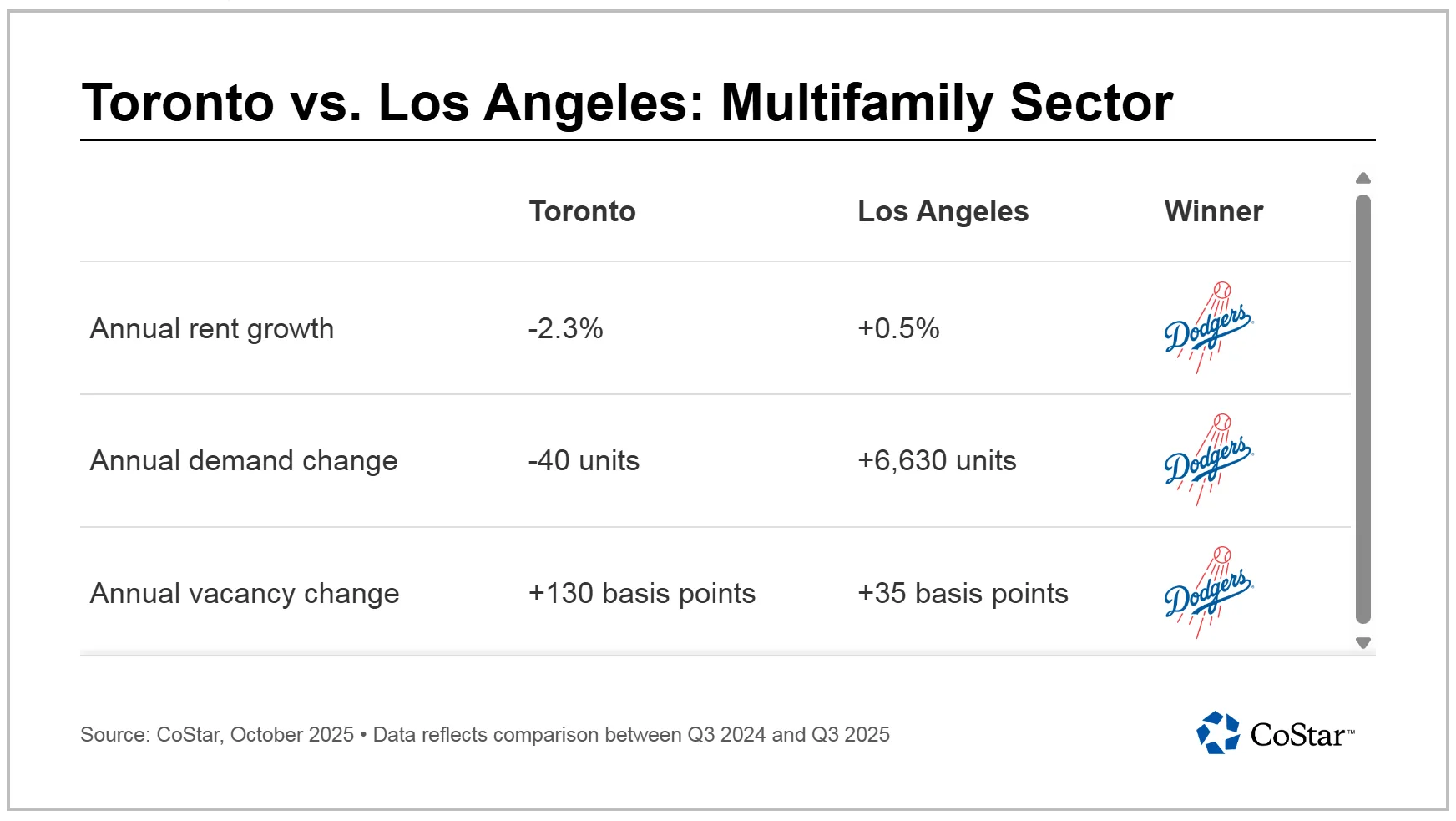

Multifamily: LA Leads on Balance

Despite vacancies climbing to 5.4%, Los Angeles remains below the national average, thanks to a slowdown in construction and historically steady demand. Toronto, by contrast, faces acute affordability challenges amid high rents and slowing population growth, even as it continues to expand supply.

Edge: Los Angeles.

Office: Toronto’s Recovery vs. LA’s Retrenchment

Toronto shows early signs of an office market rebound, with banks and government agencies fueling renewed leasing activity. However, Los Angeles’ move to repurpose obsolete buildings and pause new development may better position it long-term, even with higher current vacancies.

Edge: Los Angeles.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Industrial: Toronto Powers Ahead

While LA’s once-dominant industrial sector grapples with weakened demand and softening rents, Toronto has maintained a tighter grip on market fundamentals. Though current availability is rising, regulatory constraints are expected to rebalance the sector quickly—particularly if trade tensions ease.

Edge: Toronto.

Retail: Tight Margins, but LA Holds Ground

Retail conditions remain fragile in both markets. LA’s vacancies have reached a record 5.9%, largely from aging inventory and national closures. Yet Toronto saw a sharper year-over-year vacancy spike, suggesting LA’s slower decline may be more manageable for now.

Edge: Los Angeles

The Verdict: Los Angeles Wins by a Slim Margin

While neither market is in peak form, LA edges out Toronto in this head-to-head matchup, claiming victory in three out of four major CRE sectors. Structural corrections and tighter development pipelines give LA a slight lead heading into the next real estate cycle.

Winner: Los Angeles