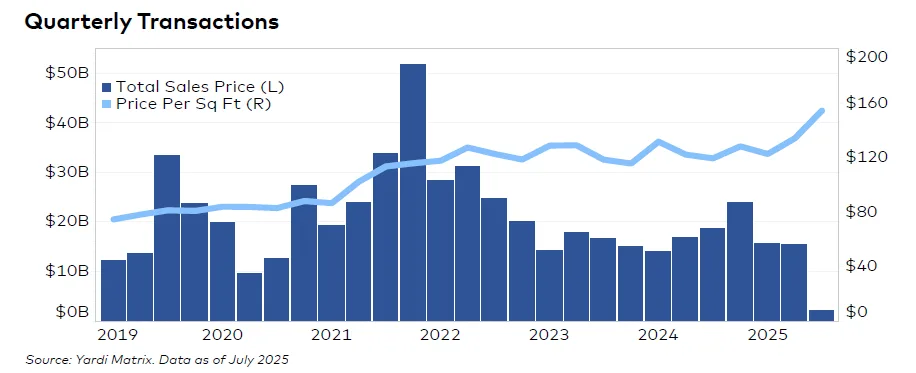

- Industrial investment remains steady in 2025, with $31.4B in sales logged in the first half of the year, on pace with recent years despite economic uncertainty.

- Average sale prices hold at $129 PSF, up just 6% since 2022 after a dramatic run-up between 2019 and 2022, reflecting a market in equilibrium.

- Rent growth continues nationally, led by Philadelphia at 9.2%, as supply begins to taper and demand remains consistent.

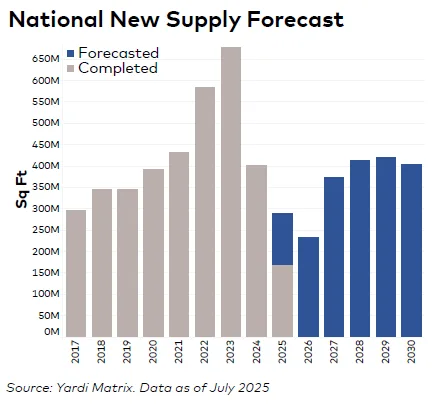

- Vacancy rates have risen to 9.1%, but are expected to level off and decline in 2026 as new supply slows and macro conditions stabilize.

Investment Slows, But Resilience Shows

Industrial real estate—once the darling of post-pandemic commercial investment—has seen its meteoric rise stabilize, reports Yardi Matrix. After peaking at $129.8B in 2021, industrial real estate investment volumes began to decline. By 2023, total investment had dropped to $64.8B. The sector saw a modest rebound in 2024, signaling a potential return of investor confidence. So far in 2025, investment activity remains consistent at $31.4B in the first half of the year, matching the same period in 2023 and 2024.

Despite the cooling, prices have held firm. The average price PSF is $129, just 6% higher than in 2022. That marks a sharp slowdown from the 54% price growth seen between 2019 and 2022. However, the stability in current pricing highlights the enduring appeal of industrial real estate. In contrast, office properties have seen prices plunge by over 30% since 2022.

Rent Growth Leaders

Rents continue to climb steadily, with national in-place rents reaching $8.63 PSF, up 6.1% year-over-year. Philadelphia led all markets, posting 9.2% rent growth thanks to strong logistics demand and port activity, despite older inventory.

Other major rent gainers include Atlanta (8.7%), Miami (8.6%), and Orange County (8.3%), highlighting ongoing demand even in the face of macroeconomic headwinds and elevated vacancies.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Supply And Vacancy

While 9.1% national vacancy may appear elevated, it’s largely the result of record-breaking deliveries in recent years. With 340M SF under construction nationally, that pace is slowing. The development pipeline is starting to normalize, and vacancy is expected to plateau and begin declining in 2026.

Some metros, like Phoenix, Dallas–Fort Worth, and Memphis, continue to see high levels of development activity. Others, such as Philadelphia and the Bay Area, have experienced a slowdown in new construction. This tapering creates an opportunity for demand to catch up with supply.

Transactions

Not all markets are equal. Baltimore posted the highest growth in sale price among top 30 metros, jumping 70% since 2022 to reach $193 PSF. The surge was driven by two major deals—KKR’s $115M acquisition and MRP Industrial’s $85.5M logistics park sale—that lifted the entire market.

In contrast, more established metros like Los Angeles ($285/SF) and Orange County ($301/SF) still command top dollar, but without the same year-over-year price spikes.

Outlook: Brighter Days Ahead

Looking ahead, rate cuts expected later in 2025, greater clarity around tariff policy, and new tax law benefits are expected to reignite activity. Investor sentiment is already turning more optimistic.

Even with tempered growth, the industrial sector continues to be a top-tier asset class, offering relative stability in an otherwise cautious CRE landscape.