- Commercial mREITs are delivering positive total returns in 2025. This is driven by easing credit stress, expected rate cuts, and stronger loan originations.

- Loan portfolios are stabilizing as losses from older loans have mostly been recognized. Newer originations are performing better.

- Diversification efforts—such as international lending and acquisitions—are helping mREITs improve earnings and manage risk.

Turning the Page: A Healthier Outlook

Commercial mREITs are finally entering a recovery phase after two difficult years, says Nareit. As of September 8, the sector had posted a 7.7% total return year-to-date. Key players like Blackstone Mortgage Trust (BXMT), Starwood Property Trust (STWD), and Apollo Commercial Real Estate Finance (ARI) are reporting strong gains, close to double digits.

The sector still faces some headwinds. Loan loss reserves have risen from about 1% in 2021 to over 4%. Non-performing loans have climbed to 8.3%, according to Keefe, Bruyette & Woods (KBW). Even so, analysts say the worst may be over. About 81% of expected losses have already been recognized, and the market is showing signs of recovery.

Cleaning Up the Past, Building Toward the Future

Most issues stem from loans originated before 2022. These were made at peak property values and have since declined by around 25%, according to Green Street. Many have now been written down, restructured, or sold.

Newer loans, made in 2024–2025 at higher spreads and lower valuations, now make up a growing part of portfolios. These newer assets are performing well and are improving earnings potential.

Capital markets are also more open. Loan repayments have picked up, and banks are once again offering warehouse lines. Securitization activity has returned, providing mREITs with access to leverage.

Favorable Market Dynamics and Spread Recovery

Commercial mREITs profit from the spread between short-term borrowing costs and long-term lending returns. This net interest margin is improving. In early 2023, the spread between the 30-year mortgage rate and the two-year Treasury was 1.70%. As of September, it has widened to 3.0%, according to Hoya Capital.

Analysts expect spreads to improve further if the Federal Reserve cuts rates. A steeper yield curve would support better earnings and dividend coverage while reducing the need for more leverage.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

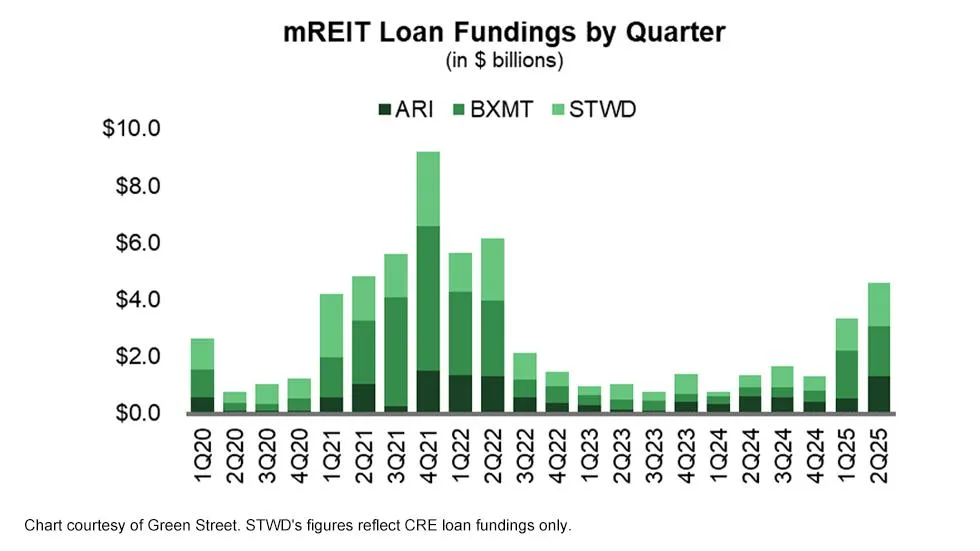

Loan Activity Picks Back Up

Another strong signal of recovery is the return of loan originations. After slowing to a halt in 2022 and 2023, new funding activity surged in early 2025. mREITs are focusing on multifamily, industrial, student housing, and data centers, while avoiding office.

Apollo and Starwood are also active in net lease and select retail deals. Starwood’s $2.2B acquisition of Fundamental Income Properties adds a stable income stream and longer-term cash flows to its portfolio.

Global Reach and Diversification

mREITs are also expanding abroad. Green Street expects about half of 2025 originations to come from markets like Europe, Canada, and Australia. These markets offer fewer financing options and attractive spreads for large deals.

Blackstone Mortgage Trust is leading this trend. More than two-thirds of its second-quarter originations came from Europe.

Looking Ahead: Cautious Optimism with Eyes on M&A

Analysts remain cautiously optimistic. Some believe sector consolidation could offer benefits like greater scale and more stable dividends. However, many firms are trading below book value, making deals harder to close.

The biggest risk is that real estate markets don’t recover as expected. If troubled assets linger, they could weigh on earnings. Rate volatility is another threat.

“mREITs can offer high yield in calm markets, but when bond markets get volatile, risks rise fast,” says Hoya Capital’s Alex Pettee.

Still, if mREITs finish cleaning up troubled assets, the sector could see a strong lift in 2026 and beyond. This recovery could even support dividend increases in the near future.

Bottom Line

Commercial mREITs are turning a corner. With better-performing loans, wider spreads, and new capital flowing in, the sector looks poised for stronger returns ahead—if market conditions continue to improve.