- Contrary to conventional wisdom, development may yield the highest returns early in the real estate cycle, not later.

- Hines Research shows that both acquisitions and development perform better in early phases of the cycle, with development offering a stronger return premium.

- As cycles mature, risk increases and returns diminish—suggesting developers may want to act sooner rather than later.

A New Look at the Real Estate Cycle

Conventional real estate wisdom has long suggested a formulaic approach: buy low early in the cycle, then build later when fundamentals recover. But a new study by Hines Research—backed by decades of historical data and over 80,000 market observations—suggests that this conventional strategy might not be the most effective.

Instead, Hines’ data reveals that development returns tend to peak earlier in the cycle and taper off in later stages, often dropping below the level needed to compensate for increasing risk.

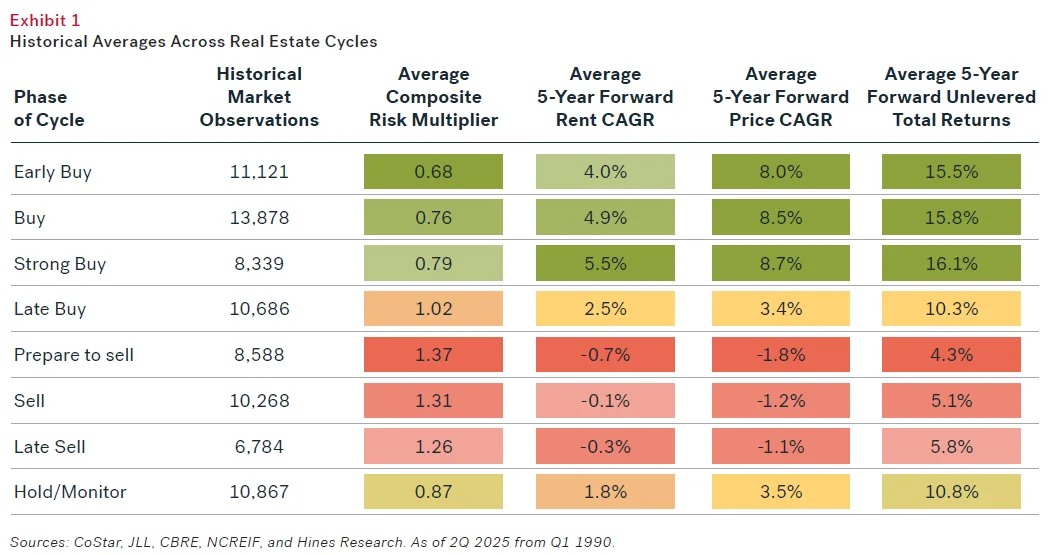

Exhibit 1 shows the average five-year forward rent growth, price growth, and total unlevered returns across each real estate cycle phase, as well as Hines’ proprietary composite risk multiplier. This visual sets the foundation for why timing is more nuanced than it seems.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Cycle Analysis: Early Risk, Long-Term Upside

Hines’ proprietary cycle framework categorizes the market into eight distinct phases—from Early Buy to Late Sell—and overlays this framework with data on capital markets, fundamentals, and pricing trends.

During the Early Buy phase, market conditions appear unattractive: rents are falling, vacancy is high, and tenant demand is soft. Institutional capital typically sits on the sidelines, and the market is dominated by more risk-tolerant private investors.

But these surface-level fundamentals often obscure a valuable truth: market prices have corrected significantly by this stage, and the risk of further declines is notably low—32% below the historical norm, according to Hines.

This creates a compelling window for strategic action, not necessarily to build immediately, but to secure land and entitlements while competition is limited and pricing is favorable.

“While you probably wouldn’t want to break ground in the earliest part of the cycle, this may be an opportunistic time to option land for the invariable improvement in market fundamentals that tend to occur as the cycle progresses,” notes Joshua Scoville, Head of Global Research.

Development Outperformance: The Data Speaks

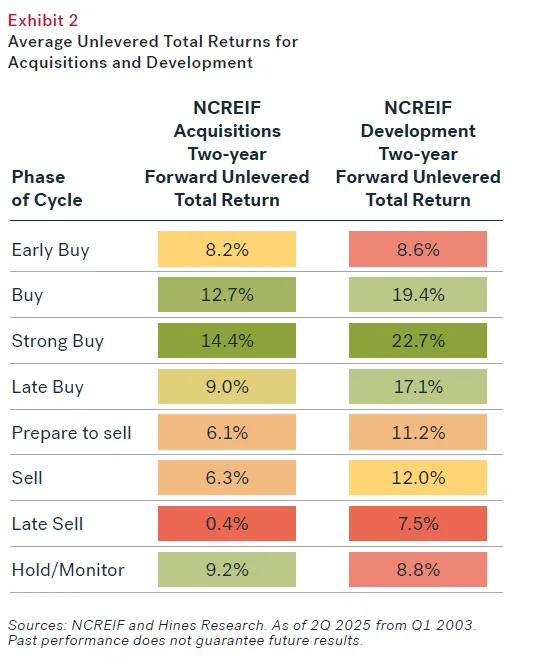

Hines compared two-year forward unlevered returns from NCREIF across both acquisition and development projects by cycle phase. The results clearly favored development, particularly during the early and mid-cycle stages.

Exhibit 2 compares average total returns for acquisitions vs. development across the cycle, highlighting just how significantly development outperforms in early and mid-cycle phases.

Key Figures from Exhibit 2:

- Strong Buy Phase: Development returns averaged 22.7%, compared to 14.4% for acquisitions.

- Late Buy Phase: Development still outperformed (17.1% vs. 9.0%).

- Sell and Late Sell Phases: Returns dropped sharply, with development averaging just 7.5% in Late Sell.

These insights reinforce the idea that waiting to develop later in the cycle may leave returns on the table, especially when compared to earlier, more opportunistic phases.

Strategic Implications for Investors

In practice, this doesn’t mean developers should rush to break ground the moment the market bottoms out. But it does underscore the need for flexible capital and a long view.

Early in the cycle, developers should consider:

- Securing land options in targeted submarkets.

- Locking in entitlements before prices and competition increase.

- Positioning for stabilized delivery into mid- or late-cycle fundamentals.

Later in the cycle, when returns shrink and risks grow, build-to-core strategies (projects held long-term for stable cash flow) may outperform merchant-build models that rely on timely exits.

This long-hold approach can help smooth over pricing volatility and make the most of stabilized cash flows in mature markets.

Dispelling the Myth

Hines’ research challenges one of real estate’s most deeply rooted assumptions: that development should follow acquisition in the cycle. The data shows otherwise.

| Phase | What to Consider |

|---|---|

| Early Buy | Option land, pursue entitlements |

| Buy / Strong Buy | Consider breaking ground, returns are strong |

| Late Buy | Build cautiously, use risk-adjusted strategies |

| Sell / Late Sell | Favor long-term holds or avoid development |

Invest with Agility, Not Assumptions

As market cycles become less predictable and more localized, strategic flexibility is essential. The best approach may not be to “buy early and build later,” but rather to evaluate every opportunity based on data, timing, geography, and sector fundamentals.

“Strategic investors often have the ability to see through commonly held beliefs to find opportunities that others may miss,” the report concludes.

The real question isn’t whether to buy or to build. It’s when and where each makes the most sense, and how data can inform that decision.